“gcash apk

Okay, here is an article about the GCash app (often referred to in the context of its APK for Android users), written in English, aiming for a length of approximately 1600 words.

Unlocking Digital Finance: A Comprehensive Guide to the GCash App (APK)

In the rapidly evolving landscape of digital finance, mobile wallets have emerged as powerful tools, transforming how people manage their money, make payments, and access financial services. Among the leaders in this space, particularly in the Philippines, stands GCash. More than just a simple digital wallet, GCash has grown into a comprehensive financial platform, often referred to as a "super app," integrating a wide array of services that cater to the daily needs of millions of Filipinos. For Android users, accessing this platform primarily involves downloading and installing the GCash app, distributed as an Android Package Kit, or APK.

This article delves deep into the world of the GCash app. We will explore what GCash is, its significance in the Philippine context, a detailed look at its extensive features, the benefits it offers users, how to get started, the crucial aspects of security, and its broader impact on the nation’s digital economy. While the term "APK" simply refers to the file format used for distributing and installing applications on Android devices, our focus will be on the official GCash application itself, which is the gateway to this digital financial ecosystem. It is paramount to emphasize from the outset that users should always download the GCash app from official and trusted sources like the Google Play Store to ensure security and authenticity.

Understanding GCash: More Than Just a Wallet

At its core, GCash is a mobile wallet service that allows users to perform various financial transactions using their mobile phones. Launched by Globe Telecom in partnership with Ant Financial (now Ant Group), GCash was initially conceived as a simple way to send and receive money via SMS. However, it has undergone significant transformation, leveraging smartphone technology and internet connectivity to become a full-fledged digital financial platform.

GCash operates under the regulation of the Bangko Sentral ng Pilipinas (BSP), the central bank of the Philippines, ensuring it adheres to strict financial regulations and security standards. This regulatory oversight is crucial for building user trust and ensuring the stability of the platform.

The term "APK" (Android Package Kit) is simply the file format used by the Android operating system for distribution and installation of mobile apps. When an Android user downloads the GCash app from the Google Play Store, they are essentially downloading and installing the GCash APK file, managed securely by the official app store. While it is technically possible to obtain APK files from other sources, doing so for financial applications like GCash is highly discouraged due to the significant security risks involved, including malware and phishing attempts. Therefore, throughout this article, references to the "GCash app" implicitly refer to the official version obtained through legitimate channels.

The Rise of GCash in the Philippines

The Philippines, an archipelago nation with a significant portion of its population being unbanked or underbanked, presented a fertile ground for the growth of mobile financial services. Traditional banking infrastructure often struggles to reach remote areas, and opening bank accounts can involve cumbersome processes. GCash stepped in to bridge this gap, offering a simple, accessible, and convenient alternative.

Its success can be attributed to several factors:

- Accessibility: A mobile phone and internet connection are often all that’s needed to get started.

- Ease of Use: The app is designed to be user-friendly, even for individuals new to digital technology.

- Extensive Network: A vast network of cash-in and cash-out partners (convenience stores, pawnshops, remittance centers, banks) makes it easy to load and withdraw money.

- Comprehensive Services: It moved beyond basic transfers to offer a wide range of services, making it a one-stop-shop for many financial needs.

- Aggressive Marketing and Partnerships: Strategic partnerships with businesses, government agencies, and celebrities have boosted its visibility and adoption.

Today, GCash is not just a financial tool; it’s deeply integrated into the daily lives of millions of Filipinos, used for everything from buying groceries to paying utility bills and even investing.

A Deep Dive into GCash Features

The true power of the GCash app lies in its extensive suite of features. What started as a simple money transfer service has evolved into a comprehensive digital ecosystem. Let’s explore some of its key functionalities:

-

Send Money: This is perhaps the most fundamental feature. Users can instantly send money to other GCash users simply by entering their mobile number. This peer-to-peer transfer is quick, convenient, and often free, making it ideal for splitting bills, sending allowances, or helping family members. GCash also offers "Send Money with a Clip," allowing users to attach photos or messages, and "Send Money to Bank Account," enabling transfers from a GCash wallet directly to traditional bank accounts.

-

Receive Money: Just as easy as sending, receiving money via GCash is seamless. Users are notified instantly when funds are transferred to their wallet. This is particularly useful for freelancers, online sellers, or individuals receiving remittances from abroad (via partners like Western Union or MoneyGram integrated within the app).

-

Pay Bills: One of the most popular features, Pay Bills allows users to settle various bills directly through the app. This includes utilities (electricity, water), telecommunications (internet, mobile post-paid), government services (Pag-IBIG, SSS, PhilHealth), credit cards, loans, school fees, and many more. Paying bills via GCash saves time and effort, eliminating the need to visit physical payment centers and queue.

-

Buy Load: Users can purchase mobile load (airtime) for their own Globe/TM numbers or send load to other Globe/TM or even Smart/Sun/TNT numbers directly from their GCash wallet. The app often features promotions and discounts on load purchases.

-

QR Payments: GCash pioneered QR code payments in the Philippines. Users can pay for goods and services at participating merchants by scanning a QR code displayed at the point of sale. This contactless payment method is fast, secure, and widely accepted across various establishments, from large retail chains to small sari-sari stores and even public transportation like tricycles.

-

Online Shopping: GCash is integrated as a payment option on numerous e-commerce websites and online platforms, both local and international. This provides a convenient and secure way to pay for online purchases without needing a credit card.

-

Cash In and Cash Out: While GCash is digital, users need ways to convert physical cash into digital funds (Cash In) and vice versa (Cash Out). GCash boasts an extensive network of partners nationwide, including convenience stores (7-Eleven, Ministop), pawnshops (Cebuana Lhuillier, Palawan Express), remittance centers, and banks (via online banking or over-the-counter deposits). This widespread network ensures accessibility for users across the country.

-

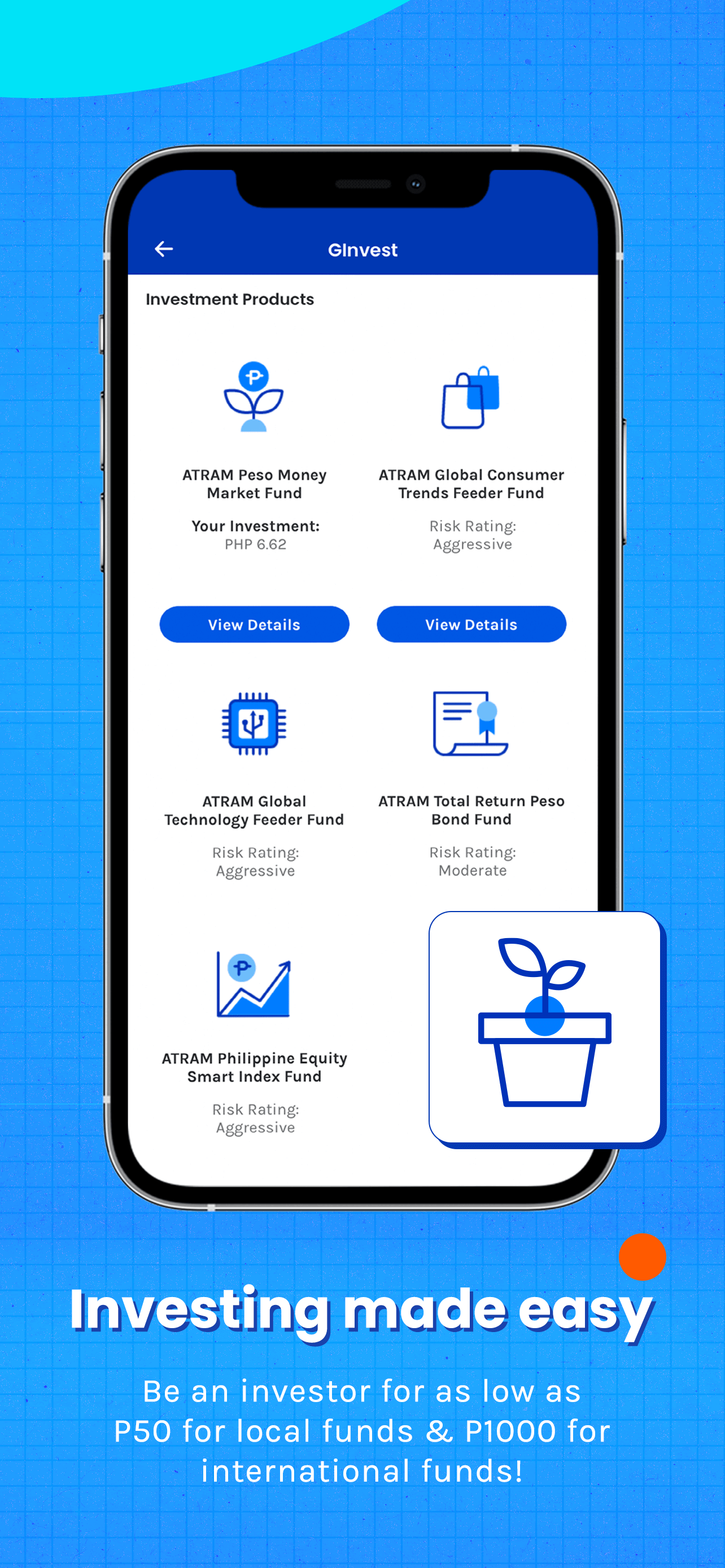

GInvest: This feature allows users to invest in various investment funds (like money market funds, equity funds) directly through the app with relatively small amounts. It democratizes investing, making it accessible to ordinary Filipinos who might have previously found traditional investment channels intimidating or requiring large capital.

-

GSave: GCash partners with licensed banks (like CIMB Bank Philippines and BPI) to offer savings accounts that can be opened and managed entirely within the GCash app. These accounts often offer competitive interest rates and do not require initial deposits or maintaining balances, promoting a culture of saving.

-

GCredit: Eligible users can access a revolving credit line based on their GCash usage and transaction history. GCredit can be used to pay for goods and services via QR, pay bills, or even cash out to their GCash wallet, providing a flexible short-term financing option.

-

GInsure: Users can purchase various types of insurance coverage directly through the app, including health insurance, accident insurance, and even vehicle insurance. This makes insurance more accessible and affordable for many Filipinos.

-

GLife: Positioned as a "super app" feature, GLife integrates various merchant partners within the GCash app itself. Users can order food, shop for groceries, book services, and more from partner businesses without leaving the GCash environment. This creates a seamless lifestyle and e-commerce experience.

-

GCash Padala: A dedicated feature for sending money specifically for remittance purposes, often targeting individuals sending support to family members in provinces.

-

GCash Forest: An innovative feature that allows users to earn "green energy" points from their GCash transactions, which can then be used to plant virtual trees. These virtual trees correspond to actual trees planted by GCash and its partners, promoting environmental sustainability.

This extensive list of features highlights how GCash has evolved from a simple mobile wallet to a comprehensive platform addressing a wide spectrum of financial and